Further Negotiation According to real estate company Bama Homes, Fannie Mae will negotiate with a buyer, but only up to a point. To find a list of Fannie Mae owned properties in your area visit. Fannie Mae may accept, reject or counter your offer.

You may qualify even if your credit is less than perfectĪvailable to both owner occupiers and investorsĭown payment (at least 3 percent) can be funded by your own savings a gift a grant or a loan from a nonprofit organization, state or local government, or employer For example, your mom or grandparent can be a co-borrower even though they don’t live with you. Fannie Mae also allows more co-borrowers on the loan than other loan programs allow. Fannie Mae Foreclosures Need to Sell Fast. Fannie Mae offers this period in an effort to build up an area with a large number of foreclosures. During that time, only those that will live in the property can bid on the home. For starters, you only need a 3 down payment. Fannie Mae offers a ‘First Look’ period, which is the first 20 days the home is listed. Low down payment and flexible mortgage terms (fixed-rate, adjustable-rate, or interest-only) The HomeReady program has more flexible guidelines than standard Fannie Mae loans. The increased inventory of homes that have been foreclosed on in the last several years has resulted in Fannie Mae holding more and more. HomePath mortgage financing benefits include: A new purchase program for home buyers is now available. The absence of the mortgage insurance requirement coupled with the low down payment requirement makes this one of the least expensive ways to finance a home purchase in today's market. If your hardship has been resolved and you are able to resume making your mortgage payments following your forbearance plan, a payment deferral may be the best option to immediately.

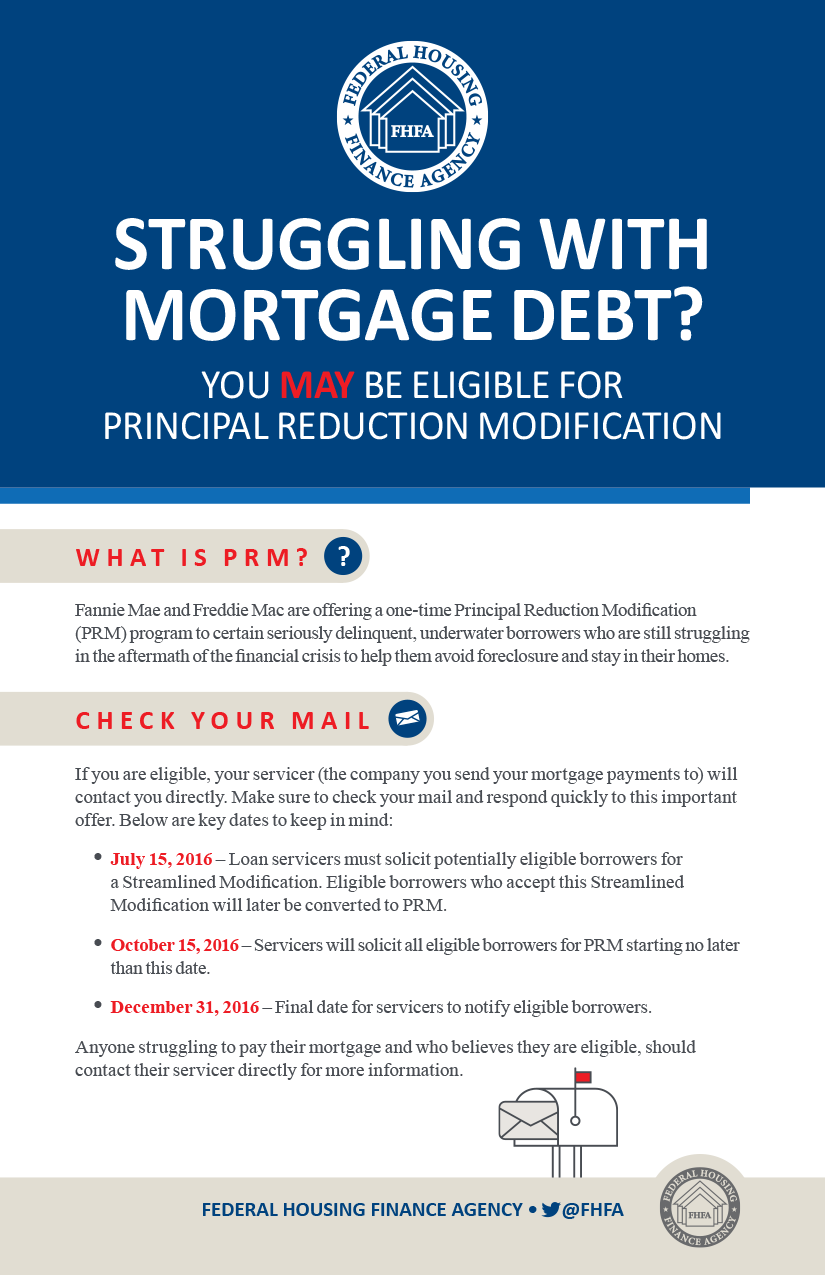

The HomePath program is a low down payment program that has no appraisal requirement and no mortgage insurance. This is a solution that brings your mortgage current, prevents foreclosure, and delays repayment of the mortgage payments you missed during your forbearance plan. Fannie Mae has now devised a program to make it easier and cheaper for home buyers to purchase a home owned by Fannie Mae. The increased inventory of homes that have been foreclosed on in the last several years has resulted in Fannie Mae holding more and more properties. For example, you may be eligible to modify your mortgage, lowering your monthly payment to make it more affordable. A new purchase program for home buyers is now available. Fannie Mae FAQ and Beware of Scams of 2 December 2015 Information on Avoiding Foreclosure Learn more About Options to Avoid Foreclosure The variety of options summarized below may help you keep your home.

0 kommentar(er)

0 kommentar(er)